Interactive Budgeting Calculators and Debt Repayment Planners Tailored for UAE Residents

Consumers in the UAE can choose between high-end purchases and basic necessities. Because of this, keeping track of your money is not only smart, it is important.

You can be a young professional in Dubai, a family growing in Sharjah, or an expat figuring out life in Abu Dhabi. Knowing where your money goes and how to handle it well can mean the difference between being financially stable and being in so much debt that you can’t pay it back.

This is where interactive budgeting calculators and debt repayment planners come in.

These tools are not just spreadsheets or theoretical exercises—they are actually designed to provide UAE residents with personalized insights and even realistic strategies for managing their money.

If you are looking for budgeting tips UAE residents actually use and benefit from, these digital tools are your starting point.

Why Budgeting Matters More Than Ever in the UAE

The economy of the UAE is growing quickly, people have a lot of extra money, and their way of life often makes them want to spend.

However, the Central Bank of the UAE and Visa’s Financial Literacy Index say that a lot of people in the UAE have trouble saving money regularly and paying off their credit card debt.

Factors that make budgeting especially important in the UAE include:

- High cost of living in urban areas

- Cultural expectations around luxury and lifestyle

- Access to easy credit, leading to potential overspending

- Expatriate life with limited long-term financial planning

You need to know how to make a budget in this case; it’s not just a good habit. Residents can become more aware, form better habits, and take real steps toward their financial goals with the right tools.

The Role of Digital Tools in Personal Finance

Traditionally, budgeting was done with notebooks or spreadsheets. Today, interactive tools have transformed the way people plan their finances. These tools offer:

- Real-time updates as you input or adjust numbers

- Customization based on income, location, lifestyle, and goals

- Visualizations like graphs and pie charts to make trends easier to understand

- Goal-setting features that show progress toward savings or debt repayment

When tailored for UAE residents, these tools can incorporate local financial specifics such as housing costs, utility expenses and even Islamic banking options therefore making them more relevant and also useful.

You might also like: Smart Budgeting Tips UAE Residents Should Know to Stay Financially Ahead

Interactive Budgeting Calculators: A Closer Look

Budgeting calculators are computer programs that help people make and stick to their budgets by letting them enter their income, spending and even savings goals. There are a number of calculators in the UAE that are designed to meet the needs of locals.

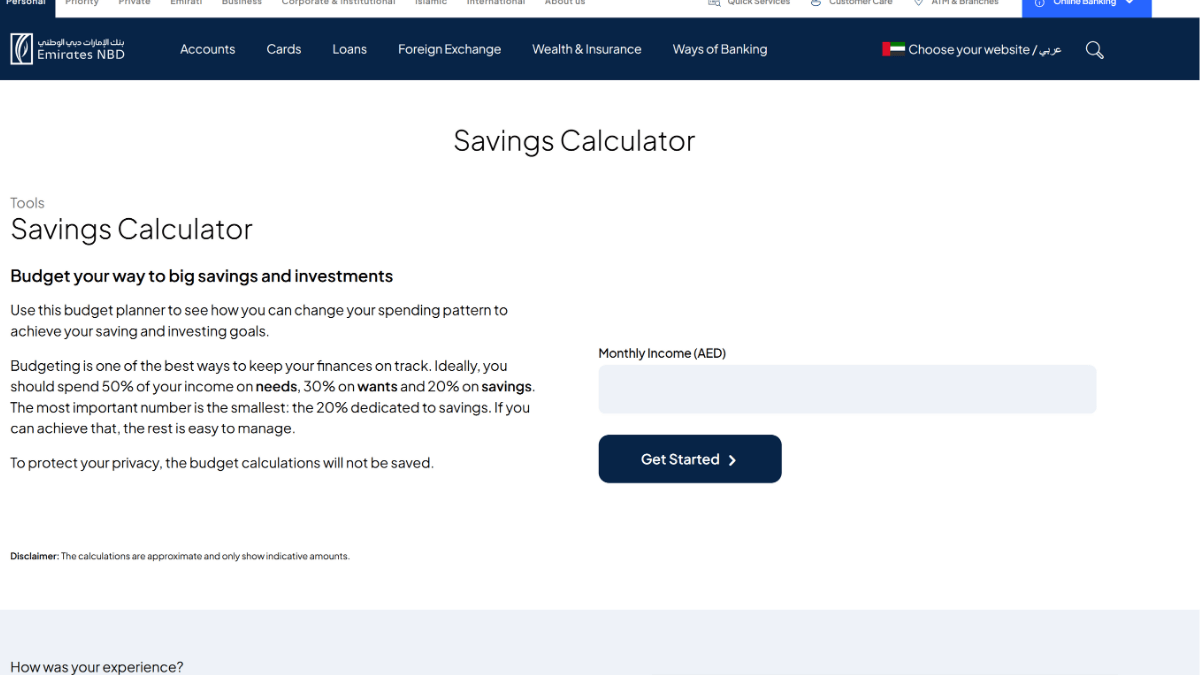

Emirates NBD Budget Planner

Source: Emiratesnbd

Emirates NBD offers a free online budget planner that assists users in tracking income and expenses, setting financial goals, and making informed money decisions.

The tool emphasizes the 50/30/20 rule, suggesting that 50% of income goes to needs, 30% to wants, and 20% to savings.

Learn More: Emiratesnbd

ADCB MoneySense Toolkit

Source: ADCB

The Abu Dhabi Commercial Bank’s MoneySense program has a lot of tools for planning, like calculators and learning materials.

Its goal is to help people learn more about money and make better decisions about how to spend and save it.

Learn More: ADCB

Sharjah Islamic Bank’s Self-Help Tool

Source: SIB

Sharjah Islamic Bank offers a Self-Help Tool that gives users a clear picture of their financial situation, helping them manage repayments effectively.

The tool is designed to be simple and user-friendly, making it accessible to a broad audience.

Learn More: SIB

Debt Repayment Planners: Managing Liabilities Effectively

Debt repayment planners are useful tools that help people come up with effective ways to settle their bills. Most of the time, they have tools that let you make payments, figure out interest and keep track of your progress.

Emirates NBD Debt Assist

Source: EmiratesNBD

The Emirates NBD Debt Assist program helps people who are having trouble paying their debts by making personalized plans to help them handle their debts and pay them back.

It’s important to understand costs and work with debt service partners to find answers as part of the program.

Learn More: EmiratesNBD

ADIB Debt Settlement

Source: Adib.com

Abu Dhabi Islamic Bank offers a debt settlement program that consolidates liabilities for lower monthly installments, helping individuals save money and achieve a more balanced financial life.

The program includes benefits like competitive profit rates and installment postponements.

Learn More: Adib.com

Lin International Debt Management

Source: Lin Intenational

Lin International provides comprehensive debt management services, including evaluation of credit profiles, planning solutions, and assistance in getting out of debt. Their services are tailored to the unique financial landscape of the UAE.

Learn More: Lin Intenational

Exploring Budgeting Tools for UAE Residents

1. Monthly Budget Calculators

You can add your monthly income and expenses for things like rent, groceries, transportation, fun, and savings into these easy-to-use tools. The tools made for the UAE stand out because they often:

- Factor in housing allowances (common in employment contracts)

- Include Zakat calculators for Muslim users

- Account for international remittances, which are a key component of many expats’ financial lives

Top features to look for:

- Local currency support (AED)

- UAE tax-free salary settings

- Scenario-based budgeting (e.g., single vs. family income)

A good example is the budgeting calculator offered on the Invest UAE platform, which helps citizens and residents evaluate their current financial habits and set more informed goals.

While budgeting helps control spending, debt repayment planners tackle existing financial obligations. In the UAE, debt can accumulate quickly—from personal loans and car financing to credit card bills.

2. Debt Repayment Planners

These tools help residents understand how much they owe, calculate interest, and prioritize which debts to pay off first. Many tools offer two main strategies:

- Snowball method: Pay off the smallest debts first to build momentum

- Avalanche method: Focus on debts with the highest interest rates

Some UAE-based planners also include:

- Islamic finance compliance features

- Guidance on Tawarruq-based debt solutions

- Integration with local banks to pull real-time data (on consent)

Using a debt planner tailored for the UAE helps residents avoid legal trouble from bounced cheques, manage repayment timelines better, and plan for a debt-free future.

You might also like: Effective Debt Management Strategies for Residents in the UAE

Comparing Popular Tools for UAE Users

Here’s a snapshot comparison of popular tools designed for UAE residents:

| Tool Name | Best For | UAE Features | Platform |

|---|---|---|---|

| YallaBudget | Basic budgeting | Local expense categories, Arabic language support | Mobile app |

| Invest UAE Planner | Financial goal tracking | Built by UAE government, goal-based planning | Web-based |

| Souqalmal Budget Tracker | Debt and expense control | UAE-centric financial products | App + Web |

| Zoya Finance | Ethical budgeting | Islamic-compliant investments and budgeting | App |

How to Choose the Right Tool for Your Needs

Choosing the right budgeting or debt management tool comes down to your lifestyle and goals. Here are a few questions to ask yourself:

- Do you want an automated solution or a manual tracker?

- Are you focused on saving, debt repayment, or investment planning?

- Do you require Islamic finance compatibility?

- Is mobile access important for you?

Whatever your goals, ensure the tool provides enough flexibility to grow with your changing financial life. The UAE is a unique landscape, and your budget should reflect that.

Tips to Maximize the Benefits of Financial Tools

Once you’ve selected a budgeting calculator or debt planner, the next step is making it a habit. Here are a few tips to make the most of it:

- Set realistic goals: Whether it’s saving AED 1,000 a month or repaying a loan within a year, keep it achievable.

- Review weekly: A weekly check-in helps catch overspending early.

- Use notifications: Set alerts for due dates, low balances, or spending limits.

- Plan for emergencies: Add a category in your budget for unexpected expenses like car repairs or medical bills.

- Track income changes: If you receive a bonus or allowance, update your tool immediately.

What UAE Government Is Doing to Support Financial Literacy

The UAE government has taken the initiative to make people more aware of money issues by creating websites like Invest UAE that offer resources and tools for using money wisely and spending.

Initiatives like school-based financial education programs and employer-sponsored financial health programs are also being considered.

As part of Vision 2030, financial health is seen as a pillar of sustainable development and personal empowerment.

Using the tools provided by both government and private sectors helps align your personal finance journey with national goals.

Conclusion: The Right Tools Make All the Difference

In a country where modern living meets rapid financial opportunities, staying in control of your money is vital. Interactive budgeting calculators and debt planners are more than just digital tools—they are roadmaps to a more secure and confident financial life.

By using tools tailored to the local economic environment, UAE residents can build smarter budgets, reduce debt, and plan for the future.

So if you’re searching for budgeting tips UAE residents actually benefit from or strategies to tackle debt management UAE-style, start with the right digital tools—and take control today.