UAE GDP Trends: A Deep Dive into the Numbers

The UAE is creating the surfboard, not only riding the wave of transformation. This Gulf giant is leveling out its economy in 2025 with daring diversification strategies, robust non-oil sector advances, and high-stakes foreign alliances that would cause even Marvel’s Avengers to take notes. For investors and analysts, this isn’t just another market update—it’s a masterclass in strategic growth, Middle East edition. Whether you’re crunching numbers or pitching to the board, the UAE’s economic game plan is one you’ll want on your radar (and in your next deck).

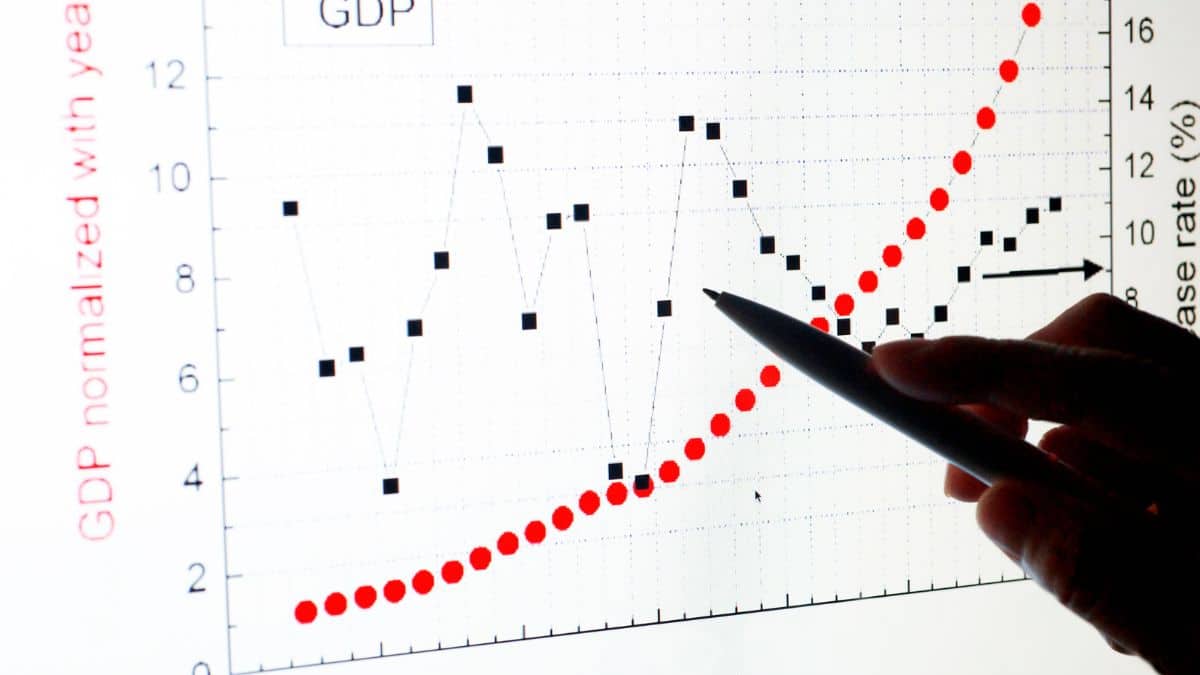

The Big Picture: UAE’s GDP Over Time

To understand where the UAE is going, you’ve got to zoom out and see where it’s been. Think of this as the box office performance chart of an economic blockbuster—spoiler: the sequel’s looking even bigger.

From Oil Boom to Diversified Boom

Over the last two decades, the UAE has gone from “oil-rich upstart” to “region-defining economic hub.” GDP growth has shown steady long-term expansion, despite global curveballs like the 2008 financial crisis, 2014 oil price dip, and the COVID-19 pandemic.

- 2020 (Pandemic Dip): GDP shrank ~6%—global shutdowns hit hard.

- 2021–2023 (Recovery Arc): Strong bounce-back, averaging 4%–5% YoY, thanks to tourism, trade, and digital sector rebounds.

- 2024 (Reboot Year): IMF puts growth at 3.8%, driven by non-oil sector gains.

- 2025 (Power-Up): CBUAE forecasts 4.7%, with the IMF going bullish at 6.7%—signaling big confidence in tech, trade, and infrastructure plays.

What’s Fueling the Growth Over Time?

- Non-oil sectors: Now contributing over 70% of GDP—led by tech, real estate, logistics, and tourism.

- Policy reforms: Corporate tax introduction, green growth strategy, 100% foreign ownership = investor magnet.

- Strategic spending: Infrastructure, education, AI—future-proofing the economy rather than just padding GDP.

Why It Matters?

This isn’t just numbers on a chart—it’s market confidence, sector growth, consumer strength, and investor opportunity all rolled into one upward-trending line. If GDP is the heartbeat of a nation’s economy, the UAE’s pulse is strong, steady, and ready to sprint.

Economic Growth Projections for 2025

Get ready to update those pitch decks—because the UAE’s economy in 2025 is looking like it just had a double shot of espresso. The Central Bank of the UAE is calling for GDP growth of 4.7%, with 5.7% on deck for 2026. Translation: this market isn’t just warming up—it’s heading into beast mode.

The magic isn’t just in oil (though the hydrocarbon sector’s expected 3.6% bump is nothing to sneeze at). The real MVP? The non-oil sector, projected to grow 5.1%—fueled by heavy hitters like tourism, transportation, financial services, and real estate. Think of it as the “Avengers Assemble” moment for UAE’s diversified economy.

So yes, OPEC+ might be easing the production cuts, but it’s the non-oil crew that’s stealing the show. Analysts tracking UAE GDP trends, sector contributions, and fiscal policy moves—this is your time to shine. Don’t just watch the numbers—zoom in on the sectors driving them.

Key Drivers of Economic Expansion

Let’s dissect the primary power-ups underlying the economic momentum of the UAE. spoiler: there is a master plan and it is more than simply oil.

Diversification: The “Don’t Put All Your Eggs in a Barrel of Oil” Strategy

The UAE is going full Tony Stark with its industrial transformation. Case in point: the “Make it in the Emirates” campaign, which is basically the country’s industrial glow-up challenge. Is there a target? Consider the industry from AED 133B to AED 300B GDP contribution by 2031.

This change is a fundamental component of lowering oil reliance and creating a balanced, shock-resistant economy, not only optics. This program merits its own slide if you are examining industrial growth and long-term budgetary resilience.

Investor takeaway: Watch for rising manufacturing, industrial innovation, and capital investment flow across non-oil verticals.

Global Power Moves: Making (Trade) Deals Like a Boss

While others swipe left on globalization, the UAE is swiping right—and locking it down. Their latest move? Free trade talks with the EU, which could unlock major flows in goods, services, FDI, and collabs in shiny sectors like AI and renewables.

Think of it as the economic version of the UAE joining the Justice League: strategic alliances with high-value partners and access to premium markets.

Analyst angle: Stronger trade corridors = more diversified export base, tech transfer, and global positioning. Get your cross-border investment radar ready.

Non-Oil Sector: The Unsung Hero Stealing the Show

Everyone talks oil. But behind the scenes, the non-oil sector is the real box office hit. In just H1 2024, it pulled off a 4.8% YoY growth, starring industries like manufacturing, logistics, real estate, and trade. For 2025, it’s eyeing a solid 5% performance.

This isn’t just background noise—it’s structural. As OPEC+ fiddles with production quotas, the non-oil machine is proving that the UAE can run the economy with (or without) high oil prices.

Pro tip for portfolio managers: Track non-oil sector performance by subsector. Logistics, financial services, and real estate are especially hot right now.

Sectoral Highlights

When it comes to understanding where the UAE’s economic heat is coming from, two sectors are doing more heavy lifting than The Rock in a summer blockbuster: Tourism & Aviation and Financial Services. Here’s your inside scoop:

Tourism and Aviation

Dubai International Airport just dropped the mic—92.3 million passengers in 2024, beating its 2018 record. That’s not just a bounce-back from COVID turbulence; that’s a full-on skyrocket.

With mega-events, luxury experiences, and visa-friendly policies, Dubai and Abu Dhabi are turning business trips into extended stays and layovers into full-blown vacations. The UAE is officially back on the global stage, and the boarding gate is packed.

Financial Services

The UAE’s banking industry is stacking real money figures like they would be playing Monopoly. With lending rose 9.5% YoY, total assets by end of 2024 reach AED 4.56 trillion. That’s not just healthy—it’s flexing.

Retail and corporate borrowers are fueling this surge, and it’s not just debt—it’s economic confidence. More borrowing means more expansion, more deals, and more IPO buzz in the air.

Economic Policies and Fiscal Health

Let’s talk about the money moves behind the UAE’s macro stability. While some countries are barely treading water, the UAE is doing fiscal laps in an Olympic-sized surplus pool—and looking good doing it.

Budget Surplus

In the first nine months of 2024, the UAE posted a fiscal surplus of AED 96.3 billion. That’s a 57.5% jump from the same period in 2023—proof that the country’s balance sheet is hitting the gym.

This windfall is fueled by a 22.1% increase in tax revenue (yes, even in a tax-light environment, they’re pulling it off) and smart capital expenditure. They’re spending where it matters—on infrastructure, innovation, and long-term economic assets.

Policy with a Plan

The UAE doesn’t wing it. Their policies are totally focused on helping significant sectors including innovation, finance, and renewable energy as well as on promoting private sector development and attracting foreign direct investment. Think of it as a “growth-first” agenda, backed by actual cash—not just press releases.

Combine this with continued regulatory modernization and economic openness (hello, 100% foreign ownership rules), and you’ve got an ecosystem that knows how to court capital—and keep it happy.

Challenges and Considerations

Even with a strong macro game and a runway full of tailwinds, the UAE economy isn’t entirely bulletproof. There are a few dragons in the dungeon—nothing apocalyptic, but definitely worth watching if you’re running models or pitching exposure.

Global Headwinds

Geopolitical tensions, interest rate volatility, and energy market swings still cast shadows. The UAE’s open economy means it’s well-integrated—but that also means it’s exposed. A slowdown in global demand or a rocky oil price ride (thanks, OPEC+ debates) can shake things up fast.

Oil Reliance Isn’t Gone Yet

Yes, diversification is in full swing, but hydrocarbons still matter. The IMF pegs UAE growth at 4% in 2025, largely anchored by strong non-oil activity—but if oil prices underperform or OPEC+ plays a different game, growth could feel it.

Execution Risk: Plans ≠ Outcomes

Though they are fascinating, major concepts like “Make it in the Emirates” and AI leadership run execution risk. All of these call for time, coordination, and capital: industrial scaling, capacity for innovation, labor skills. Not every sharp headline turns into EBITDA.

Conclusion

Zoom out, and the UAE’s 2025 economic story looks like a well-funded series with strong ratings and a greenlight for Season 2. With smart plays in non-oil sectors, savvy global partnerships, and a fiscal game that’s more “chief financial officer” than “cash burn startup,” this economy isn’t just surviving—it’s scaling.

Sure, there are a few plot twists (see: oil prices, global slowdown), but the fundamentals are solid, the vision is bold, and the execution is increasingly credible.